Business Valuation Profit Multiplier

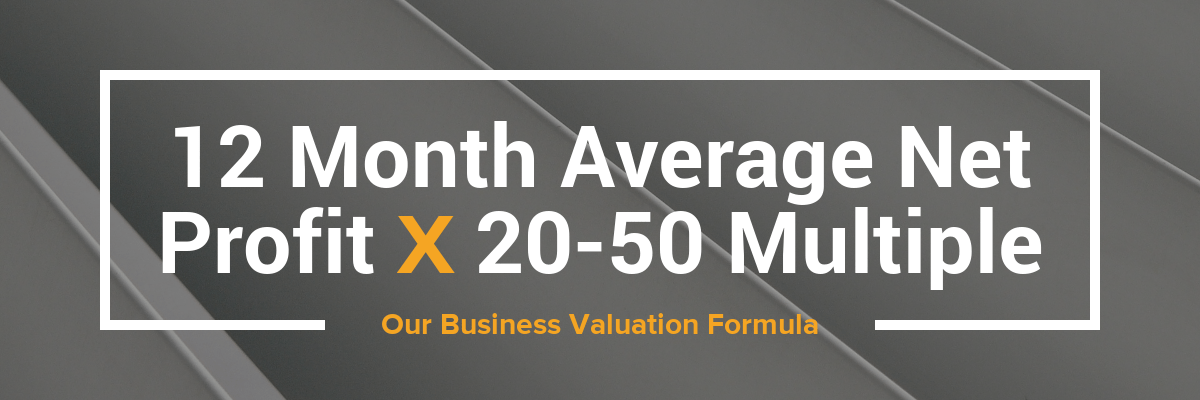

These types of business valuation calculations are usually based on earnings before interest, taxation, depreciation and amortization (ebitda) and we have therefore linked the calculation to the year 1 profit before interest and tax (pbit. Joe's family restaurant and cafe located in missouri. In profit multiplier, the value of the business is calculated by multiplying its profit. Dec 18, 2019 · comparing a franchise to an independent restaurant allows us to demonstrate how risk can factor into business valuation. It's trusted by industry leaders ranging from bankers, business brokers and business appraisers to institutions, such as the small business association (sba) and the small business development center (sbdc).

If your industry standard multiple is five times sales, and your sales revenue last year was $80,000, then your business would be valued at.

Nov 19, 2019 · a business valuation calculator helps buyers and sellers determine a rough estimate of a business's value. Dec 18, 2019 · comparing a franchise to an independent restaurant allows us to demonstrate how risk can factor into business valuation. A business valuation might include an analysis of the company's management, its capital structure, its future earnings prospects, or the market value of its assets. Apr 25, 2021 · under the times revenue business valuation method, a stream of revenues generated over a certain period of time is applied to a multiplier which depends on the industry and economic environment. For example, if your company's adjusted net profit is $100,000 per year, and you use a multiple like 4, then the value of the business will be calculated as 4 x … If your industry standard multiple is five times sales, and your sales revenue last year was $80,000, then your business would be valued at. Note that there will always be a discrepancy between the business value based on sales and the business value based on profits. It is recommended for businesses that have a large potential for growth. Nov 15, 2019 · the valuation of a business is the process of determining the current worth of a business, using objective measures, and evaluating all aspects of the business. Multipliers vary according to industry, economic climate, and other factors. The industry profit multiplier is 1.99, so the approximate value is $40,000 (x) 1.99 = $79,600. In many industries, an independent business will have more risks than a franchise and, as a result, will receive a lower valuation. Oct 27, 2020 · this being said, however, this small business valuation method, also known as the time revenue method, calculates a business's maximum worth by assigning a multiplier to its current revenue.

It is recommended for businesses that have a large potential for growth. We've been a trusted community pillar & partner for 30+ years. Nov 15, 2019 · the valuation of a business is the process of determining the current worth of a business, using objective measures, and evaluating all aspects of the business. Income based business valuation approach ; A business valuation might include an analysis of the company's management, its capital structure, its future earnings prospects, or the market value of its assets.

Nov 19, 2019 · a business valuation calculator helps buyers and sellers determine a rough estimate of a business's value.

Oct 27, 2020 · this being said, however, this small business valuation method, also known as the time revenue method, calculates a business's maximum worth by assigning a multiplier to its current revenue. If your industry standard multiple is five times sales, and your sales revenue last year was $80,000, then your business would be valued at. Joe's family restaurant and cafe located in missouri. In profit multiplier, the value of the business is calculated by multiplying its profit. Multipliers vary according to industry, economic climate, and other factors. Nov 19, 2019 · a business valuation calculator helps buyers and sellers determine a rough estimate of a business's value. In many industries, an independent business will have more risks than a franchise and, as a result, will receive a lower valuation. The industry profit multiplier is 1.99, so the approximate value is $40,000 (x) 1.99 = $79,600. Nov 15, 2019 · the valuation of a business is the process of determining the current worth of a business, using objective measures, and evaluating all aspects of the business. An income business valuation approach is a type of valuation based on projected future cash flow or earnings. These types of business valuation calculations are usually based on earnings before interest, taxation, depreciation and amortization (ebitda) and we have therefore linked the calculation to the year 1 profit before interest and tax (pbit. It's trusted by industry leaders ranging from bankers, business brokers and business appraisers to institutions, such as the small business association (sba) and the small business development center (sbdc). For example, if your company's adjusted net profit is $100,000 per year, and you use a multiple like 4, then the value of the business will be calculated as 4 x …

Income based business valuation approach ; Nov 15, 2019 · the valuation of a business is the process of determining the current worth of a business, using objective measures, and evaluating all aspects of the business. Oct 27, 2020 · this being said, however, this small business valuation method, also known as the time revenue method, calculates a business's maximum worth by assigning a multiplier to its current revenue. Joe's family restaurant and cafe located in missouri. We've been a trusted community pillar & partner for 30+ years.

The industry profit multiplier is 1.99, so the approximate value is $40,000 (x) 1.99 = $79,600.

Nov 15, 2019 · the valuation of a business is the process of determining the current worth of a business, using objective measures, and evaluating all aspects of the business. Dec 18, 2019 · comparing a franchise to an independent restaurant allows us to demonstrate how risk can factor into business valuation. In profit multiplier, the value of the business is calculated by multiplying its profit. The template also makes provision for the calculation of a business valuation based on a profit multiplier. It is recommended for businesses that have a large potential for growth. Joe's family restaurant and cafe located in missouri. For example, if your company's adjusted net profit is $100,000 per year, and you use a multiple like 4, then the value of the business will be calculated as 4 x … Nov 19, 2019 · a business valuation calculator helps buyers and sellers determine a rough estimate of a business's value. Apr 25, 2021 · under the times revenue business valuation method, a stream of revenues generated over a certain period of time is applied to a multiplier which depends on the industry and economic environment. These types of business valuation calculations are usually based on earnings before interest, taxation, depreciation and amortization (ebitda) and we have therefore linked the calculation to the year 1 profit before interest and tax (pbit. A business valuation might include an analysis of the company's management, its capital structure, its future earnings prospects, or the market value of its assets. Multipliers vary according to industry, economic climate, and other factors. An income business valuation approach is a type of valuation based on projected future cash flow or earnings.

Business Valuation Profit Multiplier. Nov 19, 2019 · a business valuation calculator helps buyers and sellers determine a rough estimate of a business's value. The industry profit multiplier is 1.99, so the approximate value is $40,000 (x) 1.99 = $79,600. Multipliers vary according to industry, economic climate, and other factors. Oct 27, 2020 · this being said, however, this small business valuation method, also known as the time revenue method, calculates a business's maximum worth by assigning a multiplier to its current revenue. Dec 18, 2019 · comparing a franchise to an independent restaurant allows us to demonstrate how risk can factor into business valuation.

Post a Comment for "Business Valuation Profit Multiplier"